Business Insurance in and around Hurricane

Get your Hurricane business covered, right here!

This small business insurance is not risky

Cost Effective Insurance For Your Business.

When you're a business owner, there's so much to keep track of. You're in good company. State Farm agent Tom Moore is a business owner, too. Let Tom Moore help you make sure that your business is properly covered. You won't regret it!

Get your Hurricane business covered, right here!

This small business insurance is not risky

Cover Your Business Assets

Whether you are a physician an HVAC contractor, or you own a candy store, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Tom Moore can help you discover coverage that's right for you and your business. Your business policy can cover things such as buildings you own and computers.

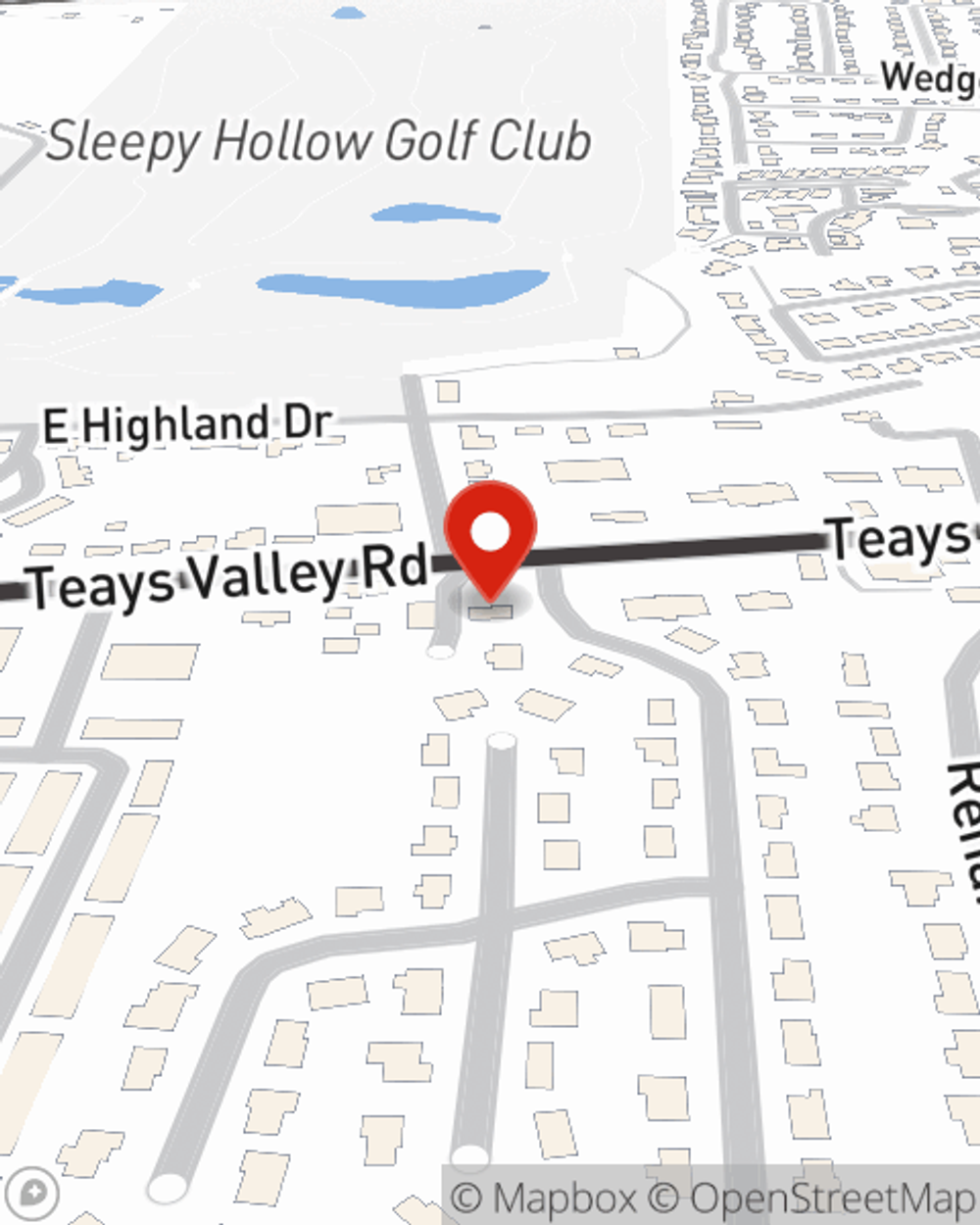

Reach out to State Farm agent Tom Moore today to discover how one of the leading providers of small business insurance can ease your worries about the future here in Hurricane, WV.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Tom Moore

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.